Understanding stock exchange hours is crucial for investors and traders aiming to optimize their strategies. Different stock exchanges around the world operate on distinct schedules, reflecting local time zones and market dynamics. This article provides an in-depth look at stock exchange trading hours, including their impact on trading strategies and how to make the most of overlapping market sessions.

What Are Stock Exchange Hours?

Stock exchange hours refer to the specific times during which a stock exchange is open for trading. These hours typically align with the business day of the exchange’s location and are influenced by regional holidays and time zone differences.

Key features of stock exchange hours include:

- Opening and Closing Times: When trading officially begins and ends.

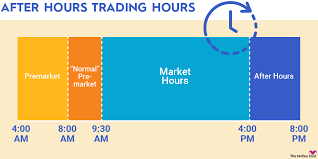

- Pre-Market and After-Hours Trading: Extended hours trading sessions before and after the official trading period.

Major Stock Exchange Hours

Below are the trading hours for some of the world’s leading stock exchanges (local times):

- New York Stock Exchange (NYSE) & Nasdaq

- Regular Hours: 9:30 AM – 4:00 PM (Eastern Time)

- Pre-Market Trading: 4:00 AM – 9:30 AM

- After-Hours Trading: 4:00 PM – 8:00 PM

- London Stock Exchange (LSE)

- Regular Hours: 8:00 AM – 4:30 PM (GMT)

- Tokyo Stock Exchange (TSE)

- Regular Hours: 9:00 AM – 3:00 PM (JST)

- Lunch Break: 11:30 AM – 12:30 PM

- Shanghai Stock Exchange (SSE)

- Regular Hours: 9:30 AM – 3:00 PM (CST)

- Lunch Break: 11:30 AM – 1:00 PM

- Euronext (Europe)

- Regular Hours: 9:00 AM – 5:30 PM (CET)

Why Stock Exchange Hours Matter

- Market Liquidity

Trading volume and liquidity are typically highest during regular market hours, leading to tighter spreads and more efficient price discovery. - Global Market Overlaps

Certain hours see overlaps between major exchanges, such as the London-New York overlap. These periods often experience higher volatility and trading opportunities. - Impact on Trading Strategies

Day traders focus on high-liquidity periods, while long-term investors may not need to monitor trading hours as closely.

How to Maximize Trading Across Stock Exchange Hours

- Understand Market Overlaps

For example, the London and New York markets overlap between 8:00 AM and 12:00 PM (EST), offering increased activity and opportunities for forex and stock traders. - Leverage Pre-Market and After-Hours Trading

These sessions allow you to react to earnings reports, economic data, or global events outside regular hours. However, they come with risks such as lower liquidity and wider spreads. - Adapt to Time Zones

If trading internationally, use tools like market clocks or trading platforms that display local times to avoid missed opportunities.

Tools and Resources for Tracking Stock Exchange Hours

At JD Trader, we provide advanced tools to help you stay updated on global market schedules:

- Real-Time Trading Platforms: Access to pre-market and after-hours trading.

- Market Alerts: Custom notifications for opening and closing times.

- Educational Resources: Tutorials on making the most of overlapping market sessions.

Conclusion

Knowing the stock exchange hours of major global markets is essential for efficient and profitable trading. By understanding when markets open and close, and identifying high-activity periods, investors can make better-informed decisions.

With JD Trader, you gain access to a world of opportunities, tools, and resources designed to help you navigate the complexities of global stock markets. Join us today and trade smarter, leveraging the full potential of market timing to achieve your financial goals.