Stock futures live updates provide investors with a powerful tool to anticipate market movements before the trading day begins. By offering insights into how stocks might perform, futures serve as a critical indicator of market sentiment and potential volatility. In this article, we’ll explore what stock futures are, their significance, and how to track them effectively.

What Are Stock Futures?

Stock futures are contracts that obligate the buyer or seller to purchase or sell a specific stock index or individual stock at a predetermined price and date in the future. Unlike spot markets, futures trade based on anticipated price movements, making them a predictive tool rather than an immediate transaction vehicle.

Key characteristics include:

- Leverage: Futures allow traders to control large positions with a fraction of the capital.

- Expiry Dates: Futures contracts have set expiration dates, usually monthly or quarterly.

- Speculation and Hedging: Traders use futures to hedge portfolios or speculate on market direction.

The Importance of Stock Futures Live Data

- Market Sentiment

Stock futures provide a snapshot of market expectations. Positive futures indicate bullish sentiment, while negative futures suggest caution or bearish trends. - Pre-Market Trading Guidance

Futures trade 24/7, offering insights into potential market behavior outside regular trading hours. This is particularly valuable for international investors or those reacting to global events. - Sector-Specific Trends

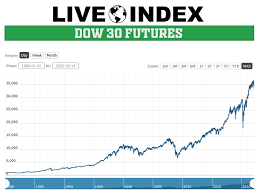

Futures on specific indices, such as the S&P 500, NASDAQ, or Dow Jones, help investors assess sector performance and make informed allocation decisions.

How to Track Stock Futures Live

To make the most of live stock futures updates, investors need reliable resources. Here are some tips:

- Real-Time Platforms

Use financial platforms like Bloomberg, CNBC, or JD Trader to access real-time futures data. These platforms offer customizable charts and alerts. - Economic Events Calendar

Stay aware of major economic announcements, such as Federal Reserve meetings or jobs reports, as they can significantly impact futures prices. - Global Market Correlations

Understand how international markets affect futures. For instance, Asian and European market movements often influence U.S. futures trading.

Benefits of Investing with Stock Futures

- Hedging Risk

Futures are an excellent tool for protecting portfolios from adverse market movements. For example, a portfolio manager might use futures to offset potential losses during earnings season. - Short-Term Trading Opportunities

Futures offer high liquidity, making them attractive for day traders seeking quick profits from small price changes. - Diversification

Index futures allow traders to gain exposure to entire markets, providing a cost-effective way to diversify portfolios.

Risks to Consider

While stock futures offer significant opportunities, they come with inherent risks:

- Leverage Risk: High leverage amplifies both gains and losses, requiring careful risk management.

- Volatility: Futures markets can be highly volatile, especially during economic uncertainty.

- Expiration Deadlines: Failing to manage positions before expiration can lead to unexpected outcomes.

Stock Futures Live and JD Trader

At JD Trader, we empower investors with advanced tools to monitor stock futures live and make data-driven decisions. From real-time alerts to expert analysis, our platform is designed to help you navigate the complexities of the futures market confidently.

Conclusion

Stock futures live updates are essential for traders and investors looking to stay ahead of market trends. By providing early indicators of market direction and offering opportunities for risk management and speculation, futures play a vital role in the investment landscape. Whether you’re an experienced trader or just starting, understanding and utilizing stock futures effectively can enhance your investment strategy.

Explore more about stock futures live updates and trading strategies with JD Trader – your trusted partner in financial success.