Stock float is an essential yet often overlooked concept in the world of investing. It refers to the number of shares of a company’s stock that are available for trading in the open market. Understanding stock float can help investors make informed decisions, especially when it comes to evaluating liquidity, volatility, and potential price movements. In this article, we’ll explore what stock float means, its significance, and how you can use it in your investment strategy.

What Is Stock Float?

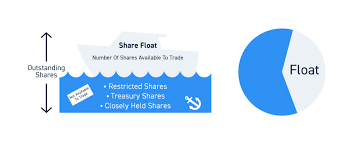

Stock float is calculated by subtracting restricted shares and shares held by insiders (such as company executives or board members) from a company’s total outstanding shares. Restricted shares are typically not available for public trading due to regulatory or contractual restrictions.

For example, if a company has 10 million outstanding shares, but 3 million are held by insiders and 1 million are restricted, the stock float would be 6 million shares.

Why Is Stock Float Important?

- Liquidity

A higher float means more shares are available for trading, which generally leads to better liquidity. Stocks with higher liquidity are easier to buy or sell without significantly affecting the price. - Volatility

Low-float stocks, on the other hand, are more volatile because a smaller number of shares can lead to larger price swings when there is high demand or selling pressure. This makes them attractive to day traders but riskier for long-term investors. - Supply and Demand Dynamics

The float directly affects supply in the market. When demand outweighs the limited supply in low-float stocks, prices can skyrocket. Conversely, an oversupply in high-float stocks can keep prices more stable.

How to Use Stock Float in Investment Decisions

- Evaluate Risk Tolerance

Investors looking for stability should focus on stocks with a higher float, while those seeking high-risk, high-reward opportunities might consider low-float stocks. - Combine Float with Other Metrics

Stock float should not be analyzed in isolation. Combine it with metrics such as average trading volume, market capitalization, and fundamental indicators like revenue and earnings growth for a holistic view. - Identify Potential Price Movements

Keep an eye on news or catalysts that could affect low-float stocks, such as earnings reports, product launches, or industry developments. These events often trigger sharp price movements.

Real-Life Example of Stock Float in Action

Consider a small biotech company with a low stock float of 2 million shares. If the company announces FDA approval for a new drug, the demand for its stock could spike dramatically, causing a sharp increase in price. Investors who understand the dynamics of stock float can anticipate and capitalize on such opportunities.

How JD Trader Supports Your Investment Journey

At JD Trader, we provide advanced tools to help you analyze stock float and other critical metrics. Our platform delivers real-time data, customizable filters, and expert insights to ensure you have the information needed to make confident investment decisions. Whether you’re exploring low-float opportunities or seeking stable, high-float stocks, JD Trader has you covered.

Conclusion

Stock float is a key metric that influences a stock’s liquidity, volatility, and potential price movements. By understanding and leveraging stock float, investors can better align their strategies with their financial goals and risk tolerance.

Ready to navigate the market with precision? Join JD Trader today and unlock tools designed for smarter investing.