Investors keeping a close eye on the banking sector often consider FRC stock, the ticker symbol for First Republic Bank. Renowned for its premium client services, First Republic is a key player in private banking and wealth management. This article explores the essential aspects of FRC stock, its market performance, and factors to consider when evaluating its investment potential.

Overview of First Republic Bank

First Republic Bank, founded in 1985 and headquartered in San Francisco, is celebrated for its client-focused approach. The bank specializes in offering tailored financial solutions for high-net-worth individuals, including private banking, business lending, and wealth management.

Listed under FRC on the New York Stock Exchange, the company has steadily expanded its reach into affluent markets across the United States. Its reputation for superior customer service and conservative financial practices has made it a preferred choice among discerning clients and investors alike.

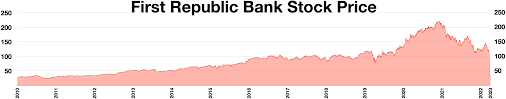

FRC Stock Performance

The performance of FRC stock has historically mirrored its strong fundamentals and disciplined growth strategy. However, like all financial institutions, it is influenced by broader economic factors, including:

- Interest Rates: As a bank, First Republic’s profitability is directly tied to the interest rate environment, which affects its net interest margin.

- Economic Trends: Consumer spending, housing market health, and overall economic growth impact its lending and mortgage portfolios.

- Market Sentiment: Banking stocks are sensitive to investor sentiment, especially during periods of economic uncertainty or volatility.

Key Strengths of FRC Stock

- High-Quality Loan Portfolio: First Republic’s conservative lending practices result in low non-performing assets, ensuring stability.

- Affluent Clientele: Catering to high-net-worth clients offers lucrative opportunities in wealth management and premium banking services.

- Regional Focus: Its concentration in wealthy regions like California and New York provides a stable and high-yield customer base.

- Brand Loyalty: The bank’s emphasis on customer service fosters strong client relationships, translating to recurring business.

Risks and Challenges

While FRC stock boasts several advantages, it is not without risks:

- Economic Downturns: Slowdowns can lead to reduced loan demand and higher default rates.

- Competition: The financial services sector is highly competitive, with both traditional banks and fintech companies vying for market share.

- Interest Rate Volatility: Rapid changes in interest rates can compress margins and impact profitability.

Recent Developments

First Republic’s strategic initiatives, including digital banking enhancements and geographic expansion, underscore its commitment to long-term growth. However, investors should stay informed about regulatory changes and economic indicators that could affect the bank’s operations.

Is FRC Stock a Buy?

For investors seeking a stable financial stock with growth potential, FRC stock offers an appealing combination. Its niche focus on affluent clients, coupled with disciplined financial practices, positions it as a strong player in the banking sector. However, due diligence is essential, particularly given the external risks that can influence its performance.

Conclusion

FRC stock reflects the strength and stability of First Republic Bank’s business model. Its focus on customer service and conservative financial practices make it a compelling choice for investors looking to add banking sector exposure to their portfolios.

At JD Trader, we empower you to make informed investment decisions. Whether you’re analyzing FRC stock or exploring other market opportunities, our tools and expertise are here to guide your journey.