In the world of stock trading, managing your entry and exit points can significantly impact your profits. One of the most effective tools for doing this is the stock limit order. Whether you’re a beginner or a seasoned trader, understanding how limit orders work and how they can benefit your trading strategy is essential. In this article, we will explore what a stock limit order is, how it works, and why it can be a vital part of your trading plan.

What is a Stock Limit Order?

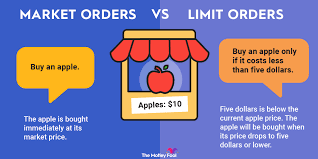

A stock limit order is an instruction you give to your broker to buy or sell a stock at a specified price or better. Unlike a market order, which buys or sells a stock immediately at the best available current price, a limit order ensures that you won’t pay more than a specific price for a stock when buying, or sell it for less than a designated price when selling.

In other words, a limit order allows you to control the price at which you buy or sell an asset, offering more precision and protection against sudden market fluctuations.

How Does a Stock Limit Order Work?

Let’s break down how a stock limit order operates with an example:

- Buy Limit Order: If you want to buy a stock but only at a price below its current market value, you can place a buy limit order. For instance, if a stock is currently trading at $50, but you only want to buy it at $45, you would place a buy limit order at $45. Your order will only be executed if the stock price reaches $45 or lower.

- Sell Limit Order: Similarly, if you want to sell a stock at a price above its current market value, you would place a sell limit order. For example, if you own a stock trading at $50 and want to sell it when the price reaches $55, you would set a sell limit order at $55. The order will only be filled if the stock price reaches or exceeds $55.

The key takeaway here is that limit orders give you control over the price at which you enter or exit a trade, helping you avoid slippage (buying at a higher price or selling at a lower price than you intended).

Benefits of Using Stock Limit Orders

There are several reasons why traders and investors choose to use stock limit orders:

- Price Control: One of the biggest advantages of limit orders is that they allow you to set the price you are willing to pay or accept. This can be especially useful in volatile markets where stock prices can swing rapidly.

- Avoiding Market Volatility: In a fast-moving market, prices can change quickly, and a market order may execute at a price far different from the one you expected. A limit order ensures that you don’t pay more (or sell for less) than the price you’ve specified, protecting you from unexpected price fluctuations.

- Better Planning and Strategy: Limit orders allow you to plan your trades in advance. If you’re targeting a specific entry or exit point for a stock, a limit order automatically executes when the price conditions are met, freeing you from having to monitor the market constantly.

- Automated Execution: Once a limit order is placed, it will remain active until the conditions are met (or the order is canceled). This means you don’t have to stay glued to the screen all day. The order will be executed automatically when the price hits your desired level.

- Improved Risk Management: By using limit orders, you can protect yourself from the potential of buying at the top or selling at the bottom of a market movement. Setting your price can help you stay disciplined and avoid emotional trading decisions.

Limitations of Stock Limit Orders

While stock limit orders offer several advantages, there are some limitations that investors should keep in mind:

- Order May Not Be Executed: A limit order will only execute if the stock reaches the specified price. In a fast-moving market, your order might never be filled if the price doesn’t hit your limit level. This is particularly true for stocks with lower liquidity or when the market moves away from your price point.

- Partial Fills: In some cases, your limit order may be partially filled if there aren’t enough shares available at the price you specified. For example, if you placed a buy limit order for 100 shares but only 50 shares are available at the limit price, you may only buy 50 shares.

- Opportunity Cost: Because limit orders are not guaranteed to execute, you could miss out on a good trade if the stock moves away from your desired price. For instance, you might set a buy limit order at $45, but if the stock price rises rapidly to $50 without hitting your price, your order won’t be executed, and you’ll miss the opportunity.

How to Use Stock Limit Orders Effectively

To make the most of stock limit orders, here are a few tips for effective use:

- Set Realistic Price Targets: When setting a limit order, consider market conditions and the stock’s recent price trends. Setting an unrealistic price target can prevent your order from being executed, and you might miss out on potential profits.

- Use Limit Orders for Specific Entry Points: If you have a target price in mind to buy a stock, placing a limit order at that price can help you achieve your goal without having to constantly monitor the market.

- Utilize Limit Orders in Volatile Markets: In volatile markets, prices can move quickly and unpredictably. A limit order can give you greater control, ensuring you don’t end up buying at an inflated price or selling too cheaply.

- Combine with Stop Losses: Limit orders can be used alongside stop-loss orders as part of a broader risk management strategy. For example, you can place a buy limit order and a sell stop-loss order to automate your entry and exit points.

Conclusion

A stock limit order is a powerful tool that allows traders and investors to take control of their trades by setting the price they are willing to pay or accept. It offers protection against market volatility, improves risk management, and helps ensure that your trades are executed at the desired price. While there are some limitations, such as the possibility that your order may not be filled, the benefits far outweigh the risks for most traders.

At JD Trader, we understand the importance of effective order execution, and we provide a wide range of tools, including stock limit orders, to help you make informed, strategic decisions in the market. By using limit orders effectively, you can optimize your trading strategy and work towards your investment goals with greater confidence.