LVMH Moët Hennessy Louis Vuitton (EPA: MC), the world’s leading luxury goods conglomerate, has consistently outperformed the broader market with impressive financial growth and strong brand positioning. For investors seeking exposure to the high-end consumer sector, LVMH stock represents a unique opportunity. With a portfolio of iconic brands such as Louis Vuitton, Dior, Moët & Chandon, and Bulgari, LVMH benefits from global demand for premium products. In this article, we delve into the factors driving LVMH’s success, its future prospects, and key risks investors should consider before investing in LVMH stock.

Strong Financial Performance and Market Dominance

LVMH stock has delivered robust returns over the past decade, reflecting the company’s ability to generate consistent revenue growth across its diverse portfolio of luxury brands. In its latest earnings report, LVMH posted a double-digit increase in revenue, driven by strong performance in its fashion and leather goods division, which contributes nearly half of total sales.

Despite global macroeconomic uncertainties, LVMH has maintained high profit margins, thanks to its pricing power and affluent customer base. The group’s strategy of acquiring and nurturing high-end brands has not only expanded its market share but also enhanced its ability to cross-sell products across different segments, from fashion and watches to wine and spirits.

Additionally, LVMH’s digital transformation initiatives have helped it tap into younger, tech-savvy consumers. Its e-commerce platforms and collaborations with influencers have boosted online sales, complementing its well-established physical retail presence in major cities worldwide.

Key Growth Drivers for LVMH Stock

- Expanding Presence in Asia

A significant portion of LVMH’s growth comes from its expanding footprint in Asia, particularly China. As the middle class in China and other Asian countries grows, so does the appetite for luxury goods. LVMH has invested heavily in opening flagship stores and developing localized marketing campaigns to strengthen brand loyalty in these markets. - Diversification Across Luxury Segments

While fashion and leather goods remain its primary revenue driver, LVMH’s diversification strategy—spanning wine and spirits, watches and jewelry, perfumes and cosmetics, and selective retailing—helps mitigate risks associated with reliance on a single segment. Notable acquisitions, such as its purchase of Tiffany & Co. in 2021, have further bolstered its position in the jewelry market. - Sustainability Initiatives

Sustainability is becoming a critical factor for luxury consumers, and LVMH has been proactive in addressing environmental concerns. Its efforts to source sustainable materials, reduce carbon emissions, and enhance supply chain transparency resonate well with socially conscious investors and consumers, making LVMH stock more attractive in the long term.

Potential Risks to Watch

While LVMH remains a dominant player in the luxury market, there are risks that investors should be aware of:

- Economic Slowdowns: Since LVMH caters to affluent consumers, an economic downturn or decline in consumer spending in key markets could negatively impact sales.

- Geopolitical Uncertainty: Trade tensions, tariffs, and political instability in regions where LVMH operates could disrupt its supply chain or sales growth.

- Currency Fluctuations: As a global business, LVMH is exposed to currency risks, particularly the euro’s fluctuations against other major currencies.

Should You Invest in LVMH Stock?

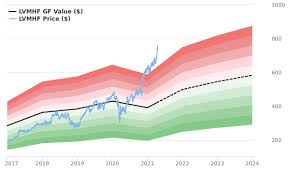

LVMH stock remains a compelling choice for long-term investors seeking exposure to the luxury sector. Its diversified portfolio, global reach, and ability to innovate while preserving brand heritage make it a resilient player in the luxury market. However, given its premium valuation, investors should be mindful of potential short-term volatility.

For those with a long-term investment horizon, LVMH stock offers an opportunity to benefit from the growing global demand for luxury goods, particularly in emerging markets. Keeping an eye on the company’s quarterly performance, expansion strategies, and macroeconomic indicators will help investors make informed decisions.

For more detailed analysis and investment insights on LVMH stock and other leading companies, JD Trader is your go-to resource. Stay updated with our expert market coverage and take control of your financial future.