Nintendo Co., Ltd. (TYO: 7974), a global leader in gaming and entertainment, is a favorite among both players and investors. For those interested in the intersection of innovation and profitability, Nintendo stock offers a unique opportunity to capitalize on the enduring appeal of gaming. But is it the right time to invest in this gaming giant? Let’s explore the key aspects driving Nintendo stock’s performance and its future potential.

A Snapshot of Nintendo’s Business Model

Nintendo is renowned for its iconic franchises such as Super Mario, The Legend of Zelda, and Pokémon. Its ability to create timeless intellectual property (IP) has secured a loyal fan base, making its games and consoles perennial favorites. The company’s hybrid console, the Nintendo Switch, has sold over 129 million units as of late 2024, cementing its position as one of the most successful gaming consoles in history.

But Nintendo’s business extends beyond gaming hardware and software. It has diversified into mobile gaming, merchandise, theme parks (Super Nintendo World), and entertainment collaborations, creating multiple revenue streams that reinforce its brand strength.

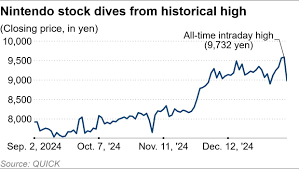

Performance of Nintendo Stock

Nintendo stock has historically been a steady performer, offering a mix of growth and stability. Over the past decade, the company has delivered impressive results, largely driven by the success of the Switch and its associated game titles.

However, the stock’s performance has seen fluctuations, particularly as investors weigh concerns over the lifecycle of the Switch console and whether the company can sustain its growth trajectory. The announcement of a next-generation console, rumored to release in late 2025, has sparked renewed interest in Nintendo stock.

Growth Opportunities for Nintendo Stock

- Next-Generation Console

One of the most anticipated developments for Nintendo is the successor to the Switch. Analysts expect the new console to leverage cutting-edge technology while maintaining the affordability and innovation that define Nintendo products. A successful launch could significantly boost hardware sales and expand the gaming ecosystem. - Recurring Revenue from Digital Sales

Digital game downloads, online subscriptions (Nintendo Switch Online), and in-game purchases are becoming increasingly important to Nintendo’s revenue mix. These recurring revenue streams offer higher margins compared to traditional game sales. - Expansion into New Markets

Nintendo continues to tap into emerging markets such as China, where gaming is growing rapidly despite regulatory challenges. Additionally, the popularity of mobile games like Pokémon GO highlights its ability to expand beyond traditional consoles. - Diversification into Non-Gaming Ventures

The success of Super Nintendo World in Japan and the U.S. showcases the company’s ability to monetize its IP outside of gaming. Upcoming expansions of the theme parks and potential media projects (such as movies) could create significant long-term value.

Risks to Consider

While Nintendo stock presents exciting opportunities, investors should also be aware of the potential risks:

- Dependence on Franchises

Nintendo relies heavily on its core franchises. While this has been a strength, over-reliance on familiar IP could make it vulnerable if consumer preferences shift. - Competitive Landscape

The gaming industry is fiercely competitive, with rivals such as Sony, Microsoft, and emerging cloud gaming platforms vying for market share. Nintendo’s unique approach has helped it stand out, but innovation will be critical to maintaining its edge. - Currency Fluctuations

As a Japanese company, Nintendo’s revenues are impacted by currency exchange rates, particularly the strength of the yen against the dollar and euro. - Console Cycles

The lifecycle of a gaming console directly influences Nintendo’s revenue. Delays or underperformance in new product launches could lead to stagnation in stock growth.

Should You Invest in Nintendo Stock?

Nintendo stock is an attractive option for long-term investors seeking exposure to the gaming industry. Its proven ability to create beloved IP, coupled with a track record of innovation, positions the company well for sustained success. However, its reliance on cyclical console launches and evolving market competition means that investors should approach with a balanced perspective.

Conclusion

Nintendo is more than just a gaming company—it’s a cultural powerhouse. For investors, Nintendo stock represents a compelling mix of legacy value and growth potential. As the company prepares to launch its next-generation console and further diversify its revenue streams, the stock could see significant upside.

That said, as with any investment, due diligence is essential. Monitoring key developments, such as the launch timeline of the new console and the performance of digital sales, will be critical for assessing Nintendo’s trajectory. For now, Nintendo stock is a player worth having on your investment watchlist—or even your portfolio.