Understanding stock order types is essential for investors looking to optimize their trading strategies and manage risk effectively. Different order types allow traders to control how their trades are executed, ensuring they buy or sell stocks under favorable conditions. This article explores the most common stock order types and how investors can use them to enhance their trading experience.

What Are Stock Order Types?

Stock order types dictate how a trade is executed in the market. By choosing the right type, investors can control price, timing, and execution conditions. The primary stock order types include:

- Market Order – An order to buy or sell a stock immediately at the best available price. It ensures quick execution but does not guarantee a specific price.

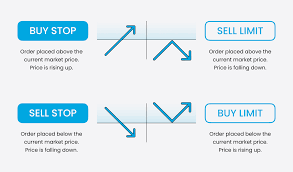

- Limit Order – An order to buy or sell a stock at a specified price or better. It provides price control but may not be executed if the market price does not reach the set limit.

- Stop Order (Stop-Loss Order) – A trade that executes when a stock reaches a predetermined price, helping to limit potential losses.

- Stop-Limit Order – A combination of a stop order and a limit order, which activates a limit order when the stock hits a specified stop price.

- Trailing Stop Order – A dynamic stop order that adjusts as the stock price moves, allowing traders to lock in profits while limiting losses.

How to Use Different Stock Order Types Effectively

- Market Orders for Quick Execution – Best for investors who prioritize speed over price and want immediate trade execution.

- Limit Orders for Price Control – Useful for buying stocks at a desired price and avoiding overpaying in volatile markets.

- Stop Orders for Risk Management – Ideal for protecting gains and minimizing losses by setting automatic exit points.

- Stop-Limit Orders for Precision – Recommended for investors who want to set a clear entry or exit strategy with controlled pricing.

- Trailing Stops for Profit Protection – A great tool for traders who want to capture gains while limiting downside risk.

Choosing the Right Order Type for Your Trading Strategy

The best stock order type depends on your trading objectives and risk tolerance:

- Day traders often use market orders and limit orders for fast execution and price control.

- Long-term investors may benefit from limit orders and stop-loss orders to manage entry and exit points.

- Active traders might use trailing stops and stop-limit orders to automate trading strategies.

Final Thoughts

Mastering stock order types is crucial for successful investing. By understanding how different orders work and when to use them, traders can maximize efficiency, minimize risk, and take advantage of market opportunities.

At JD Trader, we provide advanced trading tools and insights to help investors navigate the stock market confidently. Start trading smarter today with JD Trader!