Stock dividends play a crucial role in long-term investing, providing investors with additional shares instead of cash payouts. For those analyzing historical dividend trends, understanding the O stock dividend history can offer valuable insights into a company’s financial stability, growth prospects, and overall investment potential.

What Is a Stock Dividend and Why Does It Matter?

A stock dividend is when a company issues additional shares to existing shareholders rather than distributing cash. Companies often do this to reward investors while conserving cash for growth and expansion. Stock dividends are generally expressed as a percentage, meaning shareholders receive additional shares based on the number they already own.

Tracking a company’s dividend history allows investors to assess:

- Consistency and reliability of dividend payments

- Growth trends in dividend issuance

- Financial health and profitability of the company

O Stock Dividend History: Key Trends and Insights

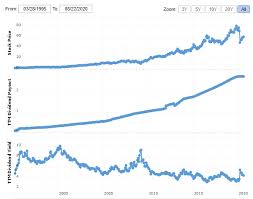

To evaluate O stock dividend history, investors typically look at several factors:

- Dividend Frequency and Payouts

Companies with a strong dividend history tend to issue dividends regularly. Investors should analyze how frequently dividends have been paid and whether there have been increases, decreases, or suspensions over time. - Dividend Yield and Growth Rate

The yield and growth rate of stock dividends provide insight into a company’s financial health. A stable or growing dividend payout suggests a well-managed company with strong earnings potential. - Market Performance and Investor Sentiment

A company with a solid stock dividend history often attracts long-term investors who seek steady returns. Examining past dividend trends can help determine whether the stock aligns with an investor’s financial goals.

The Impact of Dividend History on Investment Decisions

Investors use dividend history to make informed decisions about stock purchases and portfolio management. Some benefits of investing in companies with a strong dividend track record include:

- Long-term wealth accumulation through compounding growth

- Potential tax advantages when dividends are reinvested

- A hedge against market volatility since dividend-paying stocks tend to be more stable

However, investors should also be cautious of potential risks, such as dividend cuts, market downturns, or changes in company policy that could impact future payouts.

Conclusion

Understanding the O stock dividend history is essential for investors looking to assess the financial strength and long-term potential of a stock. By analyzing dividend trends, payout consistency, and overall growth, investors can make informed decisions that align with their financial objectives. A strong dividend history often signals stability and reliability, making it a key factor in building a successful investment portfolio.

Would you like any refinements or specific data points added to enhance SEO ranking?