Orlando Corporation (NYSE: O), commonly known as Realty Income, is a popular real estate investment trust (REIT) that has gained investor interest due to its consistent dividend payments and long-term growth potential. In this article, we will provide an O stock forecast, analyzing its historical performance, current market conditions, and future growth prospects.

O Stock Performance Overview

Realty Income has established itself as a dividend aristocrat, boasting a strong track record of monthly dividend payments. As a REIT, the company primarily invests in commercial properties, securing long-term lease agreements with stable tenants. This has helped it maintain steady revenues even during economic downturns.

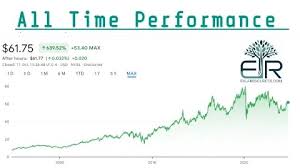

Over the past five years, O stock has shown resilience, with moderate but steady growth. However, interest rate fluctuations, inflation concerns, and shifts in the real estate market have influenced its stock performance.

Factors Influencing O Stock Forecast

- Interest Rates and Federal Reserve Policies

Since REITs are sensitive to interest rate changes, Realty Income’s stock tends to react to Federal Reserve rate hikes or cuts. Higher interest rates generally increase borrowing costs, potentially affecting expansion plans and profitability. Conversely, rate cuts could make REITs more attractive to investors seeking yield. - Real Estate Market Trends

Realty Income focuses on acquiring and managing retail and commercial properties. Trends in the retail sector, including the rise of e-commerce and changes in consumer behavior, can impact rental income and property values. However, the company’s strategy of leasing to high-quality tenants with long-term contracts provides stability. - Dividend Yield and Investor Sentiment

Realty Income is well-known for its monthly dividend payments, making it an attractive choice for income-focused investors. A high dividend yield often supports stock price stability, as investors prioritize consistent income over short-term price fluctuations. - Earnings Growth and Expansion Strategies

Realty Income continues to expand its portfolio by acquiring properties across diverse industries, including healthcare, industrial, and entertainment sectors. The company’s ability to secure profitable deals and maintain high occupancy rates will be crucial for its future stock performance.

O Stock Forecast for 2024 and Beyond

Given the current economic outlook, analysts have mixed opinions on O stock. While Realty Income remains a strong dividend-paying stock, external factors like interest rate volatility and potential economic slowdowns could affect short-term stock performance.

- Bullish Scenario: If interest rates stabilize or decrease, Realty Income could benefit from lower borrowing costs, driving stock price appreciation. A strong property portfolio and consistent rental income would continue to attract dividend investors.

- Bearish Scenario: If inflation remains high and the Fed maintains a restrictive policy, O stock could face headwinds. Higher borrowing costs and potential tenant struggles could limit growth.

Conclusion: Is O Stock a Good Investment?

For long-term investors seeking stable income and gradual capital appreciation, O stock remains an attractive option. Its monthly dividends, diversified property portfolio, and reliable cash flow make it a resilient REIT investment. However, short-term volatility driven by macroeconomic conditions should be considered before making an investment decision.

Investors should closely monitor interest rate trends, economic conditions, and Realty Income’s earnings reports to make informed decisions regarding O stock in 2024 and beyond.