Investors and traders rely on accurate calculations to measure their gains and losses in the stock market. A stock profit calculator is a powerful tool that helps investors determine potential profits, evaluate risk, and optimize trading decisions. Whether you’re a beginner or an experienced trader, understanding how to use a stock profit calculator can significantly enhance your investment strategy.

What is a Stock Profit Calculator?

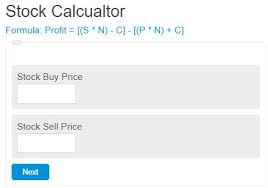

A stock profit calculator is an online or software-based tool designed to help investors compute their stock market earnings or losses based on key inputs such as:

- Purchase Price – The price at which the stock was bought.

- Selling Price – The price at which the stock is sold.

- Number of Shares – The total shares purchased or sold.

- Commission Fees – Brokerage charges and transaction costs.

- Taxes – Applicable capital gains taxes or other levies.

By entering these values, traders can quickly determine their net profit or loss on a stock trade.

Why Use a Stock Profit Calculator?

1. Accurate Profit Estimation

Manual calculations can be time-consuming and prone to errors. A stock profit calculator automates the process, ensuring precise results for better decision-making.

2. Risk Management

Understanding your potential gains and losses before executing a trade allows you to assess risks and adjust your strategy accordingly. You can set stop-loss and take-profit levels based on calculated returns.

3. Easy Portfolio Analysis

A stock profit calculator helps investors track multiple trades, compare different investment scenarios, and optimize their portfolio performance over time.

4. Tax Planning

Capital gains taxes can impact net profits. By factoring in tax rates, investors can plan their trades strategically to minimize tax liabilities.

How to Use a Stock Profit Calculator?

Using a stock profit calculator is simple. Follow these steps:

- Enter the Purchase Details:

- Input the buying price per share.

- Enter the number of shares purchased.

- Include any brokerage fees.

- Enter the Selling Details:

- Input the selling price per share.

- Enter the number of shares sold.

- Include any selling commissions.

- Calculate the Profit or Loss:

- The calculator will subtract total purchase costs from total selling proceeds.

- It will also deduct brokerage fees and applicable taxes to show the net profit or loss.

Example Calculation:

Imagine you bought 100 shares of a stock at $50 per share and sold them at $65 per share. If the commission fee is $10 per trade, your calculation would be:

- Total Purchase Cost = (100 × $50) + $10 = $5,010

- Total Selling Revenue = (100 × $65) – $10 = $6,490

- Net Profit = $6,490 – $5,010 = $1,480

This simple calculation helps investors quickly understand their stock trade profitability.

Choosing the Best Stock Profit Calculator

There are many stock profit calculators available online. When selecting one, consider:

- User-Friendly Interface – Ensure it is easy to use and provides clear outputs.

- Customization Options – A good calculator allows you to input brokerage fees, taxes, and other costs.

- Real-Time Data Integration – Some advanced calculators link with live market data for accurate projections.

Conclusion

A stock profit calculator is an essential tool for investors who want to make informed trading decisions and maximize their profits. By automating profit calculations, managing risks, and planning tax-efficient trades, investors can enhance their financial success in the stock market.

At JD Trader, we provide top-tier investment tools and insights to help traders make smarter financial decisions. Try our stock profit calculator today and take control of your investment strategy!