As one of the most influential tech companies globally, Google stock, traded under Alphabet Inc. (NASDAQ: GOOGL for Class A shares and GOOG for Class C shares), is a popular choice for investors. Google’s parent company, Alphabet, dominates sectors like digital advertising, cloud computing, and artificial intelligence, making its stock a prime option for those seeking both growth and stability.

What Is Google Stock?

Google stock represents ownership in Alphabet Inc., a multinational technology conglomerate. The two stock classes—GOOGL (voting rights) and GOOG (non-voting)—give investors flexibility based on their governance preferences.

Google Stock Performance

Alphabet has consistently outperformed market expectations, driven by its diversified revenue streams:

- Digital Advertising: The largest source of income comes from Google Ads, leveraging billions of daily searches and YouTube viewership.

- Cloud Computing: Google Cloud continues to expand, offering services to enterprises across the globe.

- Other Bets: Initiatives like Waymo (autonomous vehicles) and DeepMind (AI research) reflect Alphabet’s commitment to innovation.

Why Invest in Google Stock?

- Market Leadership: Alphabet is a dominant player in digital advertising and search, with Google holding over 90% of the search engine market share.

- Robust Financials: Alphabet consistently delivers strong earnings, high margins, and significant free cash flow.

- Growth in Emerging Tech: Investments in AI, cloud services, and hardware provide Alphabet with future growth avenues.

- Resilience in Challenging Times: Google’s ad business has proven resilient even during economic downturns, due to its essential role in business visibility.

Risks to Consider

- Regulatory Pressures: Alphabet faces scrutiny regarding data privacy and monopolistic practices, especially in the EU and U.S.

- Competition: Rivals like Amazon, Meta, and Microsoft challenge Alphabet in key sectors like advertising and cloud computing.

- Economic Cycles: Digital ad revenues are susceptible to changes in economic conditions.

How to Evaluate Google Stock

- Earnings Reports: Look at quarterly financials, focusing on ad revenue, Google Cloud growth, and “Other Bets” spending.

- Innovation Metrics: Monitor Alphabet’s advancements in AI and other emerging technologies.

- Market Trends: Stay informed about global tech industry developments and their potential impact on Alphabet’s stock.

Tools for Investing in Google Stock

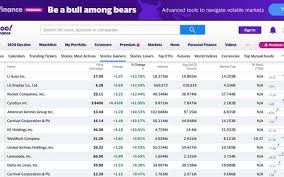

JD Trader offers cutting-edge tools to support your investment journey:

- Real-Time Market Insights: Get up-to-date data on Google stock’s price movements and breaking news.

- Advanced Analysis: Access expert insights and financial breakdowns of Alphabet’s performance.

- Portfolio Optimization: Tailor your investments with JD Trader’s customized portfolio solutions.

Long-Term Outlook for Google Stock

Google stock remains a cornerstone for tech-savvy investors. Its leading position in advertising, coupled with growth potential in cloud computing and AI, makes it a robust choice for long-term portfolios. Alphabet’s diversified approach and innovation-driven culture ensure that it stays ahead of the curve, even amid market volatility.

Conclusion

Whether you’re an experienced investor or new to the market, Google stock offers opportunities for significant returns and portfolio growth. With JD Trader, you can make informed decisions, backed by professional tools and insights, to capitalize on this tech giant’s potential.

Invest in Google stock with JD Trader today and unlock your financial future!