JPMorgan Chase & Co. (JPM) is a powerhouse in the global financial industry, making JPM stock a focal point for investors seeking stability and long-term growth. This article delves into why JPM stock is a significant addition to any portfolio, examining its performance, strengths, and potential as an investment opportunity.

What is JPM Stock?

JPMorgan Chase, often identified by its stock ticker JPM, is one of the largest financial institutions in the world. With operations spanning investment banking, asset management, and consumer banking, it is a cornerstone of the global financial system. JPM stock is listed on the New York Stock Exchange (NYSE) and is a component of the Dow Jones Industrial Average (DJIA).

Key Reasons to Consider Investing in JPM Stock

1. Consistent Performance

JPMorgan Chase has a proven track record of strong financial performance, even in volatile markets. Its robust revenue streams and effective risk management strategies have enabled the company to navigate economic challenges effectively.

2. Attractive Dividend Yield

JPM stock offers an attractive dividend yield, making it appealing for income-focused investors. The company has consistently returned capital to shareholders through dividends and share buybacks.

3. Industry Leadership

As a leader in the financial sector, JPMorgan benefits from its scale, innovative products, and extensive global reach. Its reputation for stability and reliability enhances investor confidence.

4. Diversified Revenue Streams

The company generates income across multiple segments, including:

- Investment Banking: Global mergers, acquisitions, and capital raising.

- Consumer & Community Banking: Retail banking and credit card services.

- Asset & Wealth Management: Solutions for institutional and individual investors.

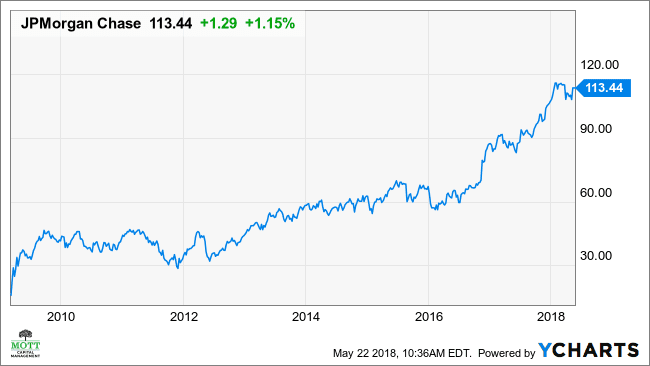

JPM Stock Performance Overview

Over the years, JPM stock has shown consistent growth, outperforming many of its peers in the banking sector. Its resilience during economic downturns highlights the strength of its diversified operations and prudent management.

Recent Highlights

- Strong quarterly earnings driven by rising interest rates.

- Continued expansion in digital banking services.

- Strategic investments in technology and sustainable finance.

Risks to Consider

While JPM stock is a solid investment, it is not without risks. These include:

- Economic Downturns: Financial stocks are highly sensitive to economic conditions, and a recession could impact profitability.

- Regulatory Changes: The banking sector is heavily regulated, and changes in policies can affect operations.

- Market Volatility: Global events and market fluctuations can influence stock performance.

Is JPM Stock a Good Investment?

JPMorgan Chase appeals to both growth and income investors. Its strong fundamentals, leadership position, and commitment to innovation make it a compelling choice. However, as with any investment, it is essential to align your decision with your financial goals and risk tolerance.

How to Invest in JPM Stock with JD Trader

At JD Trader, we provide the tools and resources to help you invest in industry-leading stocks like JPM. With expert insights, real-time market data, and user-friendly platforms, we make stock trading seamless and efficient.

Conclusion

JPM stock represents stability, growth potential, and consistent income, making it a valuable addition to any investment portfolio. Whether you are a seasoned investor or just starting, JD Trader is here to guide you every step of the way. Start your journey toward financial success by investing in JPMorgan Chase today!