PepsiCo, one of the world’s largest food and beverage companies, has been a staple in global markets for decades. For investors, Pepsi stock (PEP) represents a stable and potentially profitable option in the consumer staples sector. Known for its popular brands like Pepsi, Mountain Dew, Gatorade, Tropicana, and Lay’s, PepsiCo has built a diversified portfolio that caters to millions of customers worldwide. With JD Trader’s advanced platform, investors can gain insights and track PepsiCo’s stock performance to make informed investment decisions.

PepsiCo’s Business Model and Market Reach

PepsiCo operates in a highly competitive global market, producing a wide range of products, from beverages to snacks. Its core business segments include beverages, convenient foods, and nutrition products, all of which are widely recognized and have substantial market share across the globe. PepsiCo’s extensive distribution network allows it to dominate markets in over 200 countries, making its stocks an attractive investment option for those seeking stable returns.

The company’s strategy revolves around consistent innovation, marketing, and adapting to changing consumer preferences. With an increasing focus on health-conscious products, PepsiCo has also expanded into the “better-for-you” food and beverage category. This includes healthier drinks, low-sugar snacks, and plant-based food products, which appeal to a growing segment of health-conscious consumers.

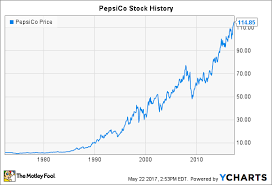

Pepsi Stock Performance: A Strong History of Resilience

Pepsi stock has a strong history of resilience, maintaining steady growth even in times of economic uncertainty. One of the key drivers behind PepsiCo’s success is its ability to generate consistent revenue through its diversified product portfolio. Unlike cyclical industries that can be significantly impacted by economic downturns, consumer staples like PepsiCo tend to perform well, as people continue to purchase food and beverages regardless of economic conditions.

Additionally, PepsiCo has a long track record of delivering attractive dividends to its shareholders. It has been a member of the Dividend Aristocrats—a group of companies that have consistently increased their dividend payouts for at least 25 years—making it an appealing choice for income-seeking investors.

Key Factors Affecting Pepsi Stock

There are several key factors that can influence the performance of Pepsi stock, and investors should keep these in mind when considering an investment:

- Economic Conditions: While consumer staples like PepsiCo tend to be less volatile than other industries, the overall economic environment still affects the company. In times of inflation or rising commodity prices, the costs of raw materials (such as sugar, corn, and packaging) can increase, potentially impacting PepsiCo’s profit margins.

- Consumer Preferences: Shifting consumer tastes towards healthier food and drink options have led to changes in PepsiCo’s product lines. The company has embraced these changes by offering low-calorie, organic, and sugar-free products. However, PepsiCo must continue to adapt to evolving consumer demands to remain competitive in the market.

- Global Expansion and Market Penetration: PepsiCo has a strong international presence, and expanding in emerging markets is a key growth strategy. However, political and economic instability in these regions can sometimes impact performance.

- Competition: PepsiCo faces significant competition from other major players in the food and beverage industry, such as Coca-Cola, Nestlé, and other regional beverage and snack manufacturers. Ongoing innovation and brand loyalty are essential for PepsiCo to maintain its competitive edge.

How JD Trader Helps Investors Analyze Pepsi Stock

With JD Trader’s platform, investors can make well-informed decisions about investing in Pepsi stock. Here’s how JD Trader can help you:

- Real-Time Stock Data: JD Trader provides access to up-to-date market data, including Pepsi stock’s price movements, trading volume, and other key metrics. This allows investors to track stock performance and make timely decisions based on real-time data.

- Comprehensive Financial Analysis: JD Trader’s tools allow investors to analyze PepsiCo’s quarterly earnings, revenue growth, and other financial indicators. This helps investors evaluate the company’s financial health and predict future growth potential.

- Technical Analysis Tools: With advanced charting tools and technical indicators, JD Trader makes it easier to analyze price trends, moving averages, and potential support and resistance levels, helping investors determine optimal entry and exit points for their investments in Pepsi stock.

- Dividend Tracking and Alerts: For dividend-focused investors, JD Trader offers features to track PepsiCo’s dividend payouts and set alerts for upcoming dividend dates. This is especially beneficial for those looking for consistent income from their investments.

Should You Invest in Pepsi Stock?

PepsiCo has proven itself as a resilient company with a diverse product portfolio, solid dividend history, and a focus on adapting to consumer trends. While Pepsi stock can be a reliable long-term investment, like all stocks, it comes with risks. Market conditions, commodity price fluctuations, and competitive pressures could affect the company’s performance in the short term.

Investors interested in PepsiCo stock should assess their financial goals, risk tolerance, and time horizon before making a decision. With JD Trader’s powerful tools, you can monitor Pepsi stock’s performance, analyze key financial data, and stay updated with market news, ensuring you make the most informed decisions possible.

Conclusion

Pepsi stock is a solid investment option for those seeking stability, growth, and reliable dividends in the consumer staples sector. With JD Trader’s intuitive platform, investors can access the tools and resources needed to analyze PepsiCo’s stock and make informed, data-driven decisions. As the company continues to innovate and expand its portfolio to meet evolving consumer needs, Pepsi stock remains a long-term growth opportunity for savvy investors. Start your journey with JD Trader and explore the potential of investing in one of the world’s most iconic brands.