Pfizer Inc. (NYSE: PFE) is one of the largest pharmaceutical companies in the world, known for its innovative medicines, vaccines, and treatments across multiple therapeutic areas. With its role in global healthcare, particularly during the COVID-19 pandemic, Pfizer stock has garnered significant attention from investors. This article takes a closer look at Pfizer’s stock performance, factors influencing its valuation, and the future outlook for potential investors.

Pfizer Stock Performance and Market Sentiment

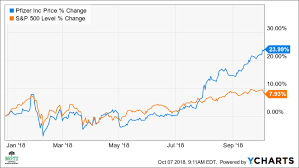

Pfizer stock has experienced notable volatility over the years, driven by several key factors, including regulatory approvals, partnerships, and clinical trial results. One of the most significant catalysts for the stock was the company’s development of the COVID-19 vaccine in partnership with BioNTech. The vaccine not only helped combat the pandemic but also significantly boosted Pfizer’s revenues and strengthened its position in the pharmaceutical industry.

As of early 2025, Pfizer stock has maintained a relatively strong performance compared to other pharmaceutical companies, largely due to its robust product portfolio and continuous investment in research and development (R&D). However, like any other major healthcare stock, Pfizer is susceptible to market fluctuations driven by patent expirations, competition, and changes in healthcare regulations.

Key Factors Driving Pfizer Stock

- COVID-19 Vaccine Sales: The Pfizer-BioNTech COVID-19 vaccine has contributed significantly to the company’s revenue. Although sales may slow as the global pandemic recedes, Pfizer has worked on expanding its vaccine offerings, including boosters and future variants, which could provide continued income streams.

- Research and Development Pipeline: Pfizer’s investment in R&D remains a key driver for the stock’s long-term growth potential. The company is actively working on new drugs and therapies across various therapeutic areas, such as oncology, immunology, and rare diseases. Success in these areas could lead to market-leading treatments, boosting both revenues and investor confidence.

- Dividend Yield: Pfizer has a strong track record of paying dividends, making its stock attractive to income-focused investors. The stability of its dividend payouts is an important consideration for those looking to invest in the pharmaceutical sector, especially in the current low-interest-rate environment.

- Mergers and Acquisitions: Pfizer has engaged in strategic mergers and acquisitions to enhance its drug portfolio and market reach. Its acquisition of Wyeth in 2009 and its 2020 purchase of Array BioPharma were pivotal in strengthening its oncology pipeline. More acquisitions in the future could further boost its earnings potential.

- Patent Expirations: On the downside, Pfizer faces challenges with the expiration of patents on some of its blockbuster drugs, which may result in generic competition and a decline in revenue from these products. However, the company is actively working on replacing lost revenue with new therapies and vaccines.

The Future Outlook for Pfizer Stock

Looking ahead, Pfizer’s ability to innovate and deliver new treatments will be critical to its stock’s performance. Its strategy of focusing on high-growth areas such as cancer therapies, rare diseases, and vaccines places it in a favorable position for the future. Investors should keep an eye on clinical trial results, regulatory approvals, and market trends as these factors will heavily influence the stock’s trajectory.

Furthermore, the global expansion of healthcare access and rising demand for pharmaceuticals in emerging markets provide an additional avenue for growth. Pfizer’s international presence and strong market penetration give it a competitive edge in these rapidly growing markets.

Conclusion

Pfizer stock offers a compelling investment opportunity, given its strong fundamentals, ongoing R&D efforts, and significant market presence. While there are risks associated with regulatory hurdles and patent expirations, the company’s diversified portfolio and commitment to innovation position it for continued success in the global pharmaceutical landscape. Investors should carefully monitor the company’s financials and product pipeline to make informed decisions about adding Pfizer stock to their portfolios.