In the fast-paced world of investing, few sectors offer as much growth potential as the quick-service restaurant (QSR) industry. One of the leading companies in this space is Restaurant Brands International (QSR stock), the parent company of iconic brands like Tim Hortons, Burger King, and Popeyes. In this article, we will explore why QSR stock is an attractive investment, the strengths of its portfolio, and what potential investors should consider before adding it to their portfolio.

What is QSR Stock?

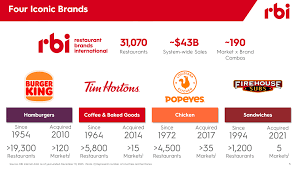

QSR stock refers to the shares of Restaurant Brands International (RBI), a global leader in the quick-service restaurant sector. Founded in 2014, RBI is a multinational fast-food holding company that owns several well-known brands, including:

- Burger King: One of the world’s largest fast-food chains, specializing in hamburgers, fries, and breakfast items.

- Tim Hortons: A Canadian coffeehouse and restaurant chain famous for its coffee, donuts, and breakfast menu.

- Popeyes: A fast-food chain known for its fried chicken and Southern-style sides.

RBI is known for its ability to scale these brands globally, driving substantial growth in emerging markets while maintaining a strong presence in mature markets like North America and Europe.

Why Invest in QSR Stock?

There are several reasons why QSR stock could be an attractive investment opportunity:

1. Strong Brand Portfolio

One of the biggest advantages of QSR stock is the strength of the brands under Restaurant Brands International’s umbrella. All three of RBI’s core brands—Burger King, Tim Hortons, and Popeyes—are globally recognized, with a significant customer base and a proven track record. By investing in QSR stock, you gain exposure to these powerhouse brands, each with its own unique value proposition and potential for growth.

- Burger King is known for its iconic flame-grilled burgers and has a large footprint worldwide, with over 18,000 locations across more than 100 countries.

- Tim Hortons is not only a beloved brand in Canada but has also been expanding its footprint in the U.S. and internationally.

- Popeyes, which gained widespread attention in recent years for its popular fried chicken sandwiches, has seen impressive growth and has successfully tapped into the growing demand for fast casual dining.

With this diverse portfolio, RBI is well-positioned to benefit from the continued global demand for quick-service dining options.

2. Consistent Revenue Growth

QSR stock has demonstrated strong revenue growth over the years, driven by the performance of its brands and the expansion into new markets. RBI’s business model focuses on franchising, which allows for scalability without the capital expenditures associated with owning and operating individual restaurants.

- Franchising Model: RBI generates revenue primarily through franchise fees, royalties, and supply chain services. This model is highly profitable because it reduces overhead costs and capital expenditure. In addition, it provides the company with a steady stream of recurring revenue.

The growth of Popeyes and the continued expansion of Tim Hortons outside of Canada have been key drivers of RBI’s financial performance, making QSR stock an appealing option for investors looking for stable cash flow.

3. Strong International Presence

RBI has a significant global presence, with its brands available in over 100 countries. This international footprint allows RBI to capture a wide range of consumers and tap into emerging markets where the demand for fast-food chains is on the rise.

- Burger King and Popeyes have particularly benefited from rapid growth in markets like China, India, and the Middle East.

- Tim Hortons is expanding aggressively in international markets, particularly in the United States and Asia.

This global diversification not only positions QSR stock for growth in emerging markets but also provides a buffer against economic downturns in any single region.

4. Potential for Dividends and Income

For income-seeking investors, QSR stock offers the potential for dividends. While Restaurant Brands International is still in the growth phase, it has made significant progress in delivering returns to shareholders. In 2020, RBI initiated its first-ever dividend payout, making it an attractive option for investors looking for a combination of capital appreciation and income.

Risks of Investing in QSR Stock

While QSR stock offers many benefits, potential investors should also be aware of the risks associated with this investment:

1. Competition in the Fast-Food Industry

The quick-service restaurant industry is highly competitive, with companies like McDonald’s, Wendy’s, and Domino’s vying for market share. As consumer preferences evolve and new trends like plant-based diets and delivery services gain traction, RBI may face challenges in adapting its brands to meet these demands. Any failure to keep up with changing trends or customer preferences could negatively impact QSR stock.

2. Economic Sensitivity

The fast-food industry is sensitive to economic conditions. During economic downturns, consumers may cut back on discretionary spending, which can affect sales for quick-service restaurants. This is especially relevant in regions where RBI operates a high concentration of stores, such as North America. As QSR stock is linked to consumer spending behavior, any prolonged economic slowdown could hurt the company’s performance.

3. Operational Risks

While RBI’s franchising model provides scalability, it also comes with challenges. Maintaining brand consistency across a global network of franchisees can be difficult, particularly in international markets where operational practices and consumer preferences may differ. Additionally, franchise agreements are typically long-term, and any disruption in these agreements or disagreements with franchisees could impact revenue.

How to Invest in QSR Stock

Investing in QSR stock is straightforward through a brokerage account. To get started:

- Open a Brokerage Account: Most major brokerage platforms, including those like JD Trader, allow you to buy shares of QSR stock.

- Research the Stock: Before investing, it’s important to research QSR stock and understand its financial performance, growth strategy, and market conditions.

- Monitor Your Investment: Once you invest in QSR stock, track its performance regularly and stay informed on any news or developments regarding the company and its brands.

Conclusion: Is QSR Stock a Good Investment?

QSR stock offers investors exposure to the growing quick-service restaurant industry through a diversified portfolio of strong, globally recognized brands. With a proven business model, ongoing international expansion, and the potential for income through dividends, Restaurant Brands International (QSR) presents a compelling opportunity for investors seeking growth and stability.

However, as with any investment, QSR stock comes with risks, particularly related to market competition and economic conditions. Investors should carefully consider these factors and maintain a long-term perspective when adding QSR stock to their portfolio.

For those looking to invest in the quick-service restaurant sector, QSR stock could be a solid choice, especially for those with a focus on growth and income. JD Trader provides investors with real-time market data and comprehensive tools to manage and track their investments in QSR stock and other high-potential opportunities.