For income-focused investors, QYLD stock (Global X NASDAQ 100 Covered Call ETF) is an attractive option due to its high monthly dividend payouts and covered call strategy. However, before investing, it’s essential to understand how QYLD stock works, its pros and cons, and whether it fits your financial goals. In this article, we’ll explore QYLD’s strategy, performance, risks, and how JD Trader can help you make informed investment decisions.

What Is QYLD Stock?

QYLD (Global X NASDAQ 100 Covered Call ETF) is an exchange-traded fund (ETF) that follows a covered call writing strategy on the NASDAQ 100 Index (NDX). This means that the fund sells call options on its holdings, generating premium income that is then distributed to investors as dividends.

- Dividend Focus: QYLD is popular among income-seeking investors because it pays monthly distributions, often yielding 10% or more annually—a significantly higher yield than most ETFs or dividend stocks.

- Covered Call Strategy: By selling call options, QYLD collects premiums but limits its upside potential. This means the ETF benefits in flat or declining markets but may underperform in strong bull markets.

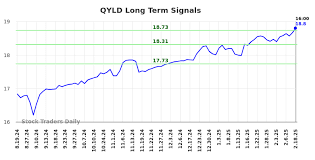

QYLD Stock Performance and Dividend Yield

One of the primary reasons investors consider QYLD stock is its high dividend yield. Over the years, QYLD has consistently paid monthly dividends, making it a favorite among passive income investors.

Key Performance Highlights:

✔ High Dividend Yield: QYLD often yields between 10%–12% annually, making it an attractive option for cash flow-focused investors.

✔ Lower Volatility: The covered call strategy reduces some volatility, making QYLD a more stable choice in uncertain markets.

✔ Limited Growth Potential: Since QYLD caps its upside by selling call options, it does not capture the full gains of the NASDAQ 100 during bull markets.

Pros and Cons of Investing in QYLD Stock

✅ Pros:

- High Monthly Income: QYLD provides consistent monthly dividends, making it ideal for retirees and income investors.

- Reduced Volatility: The covered call strategy helps mitigate downside risk compared to traditional growth ETFs.

- Exposure to NASDAQ 100: QYLD provides exposure to top tech stocks like Apple, Microsoft, Amazon, and Google while generating income.

❌ Cons:

- Capped Growth Potential: In strong bull markets, QYLD’s upside is limited because of its covered call strategy.

- Dividend Sustainability Risks: If market volatility drops, option premiums may decrease, potentially affecting distributions.

- No Dividend Growth: Unlike dividend-growth stocks, QYLD’s payouts are based on option premiums rather than increasing earnings.

Who Should Consider Investing in QYLD Stock?

QYLD stock is best suited for:

✔ Income Investors & Retirees: If you prioritize monthly cash flow over capital appreciation, QYLD is a strong candidate.

✔ Risk-Averse Investors: Those seeking exposure to tech stocks with reduced volatility may benefit from QYLD’s defensive strategy.

✔ Long-Term Passive Income Seekers: Investors looking for consistent, high-yielding dividends may find QYLD a good portfolio addition.

However, growth-oriented investors might prefer a traditional NASDAQ 100 ETF (like QQQ) to capture long-term capital appreciation.

How JD Trader Helps You Invest in QYLD Stock

JD Trader offers powerful tools to help investors analyze and trade QYLD stock effectively:

✔ Real-Time QYLD Data: Stay updated on price movements, dividend yields, and market trends.

✔ Advanced Research & Analysis: Access in-depth financial reports and performance comparisons.

✔ Dividend Tracking & Alerts: Get notifications on QYLD dividend payments and ex-dividend dates.

✔ Risk Management Tools: JD Trader helps investors set stop-loss limits and manage portfolio exposure.

Conclusion

QYLD stock is an excellent option for high-income investors who prioritize monthly dividends over long-term capital appreciation. While the covered call strategy provides stability and high yield, it also limits potential upside during bull markets.

For investors looking to maximize passive income, JD Trader provides the tools and insights needed to track QYLD stock, analyze dividend sustainability, and manage investment risks.

Start your QYLD investment journey today with JD Trader and enjoy the benefits of high-yield monthly dividends! 🚀