In recent years, the rise of commission-free trading platforms like Robinhood has revolutionized how retail investors approach stock trading. Among its many features, stock lending has emerged as a unique and potentially lucrative option for those looking to earn passive income from their stock holdings. But what exactly is stock lending, how does it work with Robinhood, and what are the potential risks and rewards? In this article, we’ll explore stock lending on Robinhood in detail, helping investors understand how to utilize this feature to their advantage while considering the associated risks.

What is Stock Lending?

Stock lending refers to the practice of lending shares of a stock you own to other traders or institutions. Typically, this is done to facilitate short selling, where the borrower bets that a stock’s price will fall. In return for lending your shares, you receive a fee, which can vary depending on the demand for the stock being borrowed. The practice is common in institutional investing, but Robinhood has brought it to retail investors, allowing individuals to earn passive income by lending their stocks through the platform.

How Stock Lending Works on Robinhood

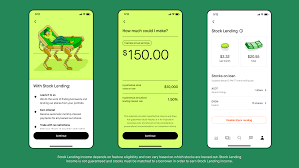

Robinhood’s stock lending program allows users to lend their eligible stocks to institutional borrowers, such as hedge funds and market makers. When you participate in the program, your shares are temporarily borrowed, and you earn a small fee based on the lending terms. Here’s how it works step by step:

- Eligibility

To participate in stock lending on Robinhood, you must have a Robinhood Gold account. Robinhood Gold is a premium subscription that offers additional features, including access to margin trading and stock lending. - Stock Selection

Not all stocks are eligible for lending. Stocks that are in high demand for short selling are more likely to generate higher fees. Robinhood will identify which stocks in your portfolio are eligible for lending, and you can choose whether to participate. - Lending Process

When you opt into the stock lending program, Robinhood will lend your shares to institutional borrowers. You continue to hold ownership of the stocks, and any dividends paid by the companies are still yours. However, you won’t be able to sell or transfer the shares until they are returned. - Earnings from Lending

The fee you earn depends on the demand for the stock you lend. In general, the higher the demand for borrowing the stock, the higher the fee you can expect. The earnings are typically credited to your Robinhood account in cash, and you can use this cash as you see fit, whether to reinvest or withdraw. - Return of Shares

Once the borrowing period ends, your shares are returned to your Robinhood account, and you can once again decide to sell or lend them out again.

Potential Rewards of Stock Lending on Robinhood

- Passive Income

One of the main advantages of stock lending on Robinhood is the opportunity to earn passive income. By lending out stocks that you’re not actively trading, you can generate additional revenue, which can be reinvested or used to offset other costs. - Low Effort

Unlike actively managing your portfolio or engaging in day trading, stock lending requires little ongoing effort. Once your stocks are lent out, you don’t need to monitor them closely. The process is fully automated by Robinhood, making it a hands-off way to earn extra income. - Access to a Larger Pool of Borrowers

By using Robinhood, you can tap into a wide range of institutional borrowers who might be seeking shares for short selling. This gives individual investors access to an opportunity traditionally reserved for institutional players. - No Impact on Stock Ownership

When you lend your shares, you still technically own them. This means that you will still receive any dividends, and your voting rights remain intact. If the stock price increases, you can sell your shares for a profit whenever you like, even during the lending period (though they would need to be returned first).

Risks of Stock Lending on Robinhood

- Liquidity Risks

While your shares are lent out, you won’t be able to sell them until they are returned. This can be a disadvantage if the stock price rises significantly, and you want to cash out. You could miss out on a lucrative sale opportunity if your shares are lent out for an extended period. - Counterparty Risk

In any lending arrangement, there’s a risk that the borrower may not be able to return the shares as agreed. Although Robinhood ensures that this risk is minimized by working with reputable borrowers, it’s still a factor to consider when lending your stocks. However, Robinhood’s system aims to mitigate these risks by ensuring that collateral is posted by the borrower. - Potential for Stock Price Decline

Stock lending is often used in conjunction with short selling. This means that the borrower may sell the borrowed shares in the market, potentially driving down the stock price. While you still own the shares during this period, you could see the stock price decline, which may limit the potential for capital appreciation. - Tax Implications

The income you earn from lending your stocks is taxable. This means that while you can earn passive income from the lending fees, you may be required to pay taxes on this income. It’s important to consult a tax professional to understand how stock lending income may affect your tax situation. - Impact on Corporate Actions

If the company whose stock you’ve lent out announces a corporate action, such as a merger, acquisition, or dividend payout, it may impact your holdings. While Robinhood will typically ensure that you still receive your dividends, certain corporate actions could be complicated by the stock lending process.

Conclusion: Should You Participate in Stock Lending on Robinhood?

Stock lending on Robinhood offers an interesting way for retail investors to earn passive income from their existing stock holdings. The program allows you to lend shares to institutional borrowers and earn fees in return, all while maintaining ownership of your stocks. However, like any investment strategy, stock lending comes with its own set of risks, including liquidity concerns, counterparty risk, and potential market volatility.

Before deciding to participate in stock lending, it’s important to carefully weigh the benefits against the risks. If you’re comfortable with the idea of temporarily losing access to your stocks in exchange for a steady income stream, this feature could be a valuable addition to your investment strategy. Always ensure you’re informed and consult with a financial advisor to understand how stock lending fits into your overall portfolio management.

Ultimately, stock lending on Robinhood can be a sweet opportunity for those looking to earn extra income, but it’s crucial to fully understand how it works and the potential downsides involved.