In the world of investing, understanding and evaluating stock names is critical to building a successful portfolio. Stock names often represent companies across diverse industries, and each carries unique characteristics that influence their market performance. This article explores how to identify and analyze stock names, offering actionable strategies for selecting the best options to align with your financial goals.

What Are Stock Names and Why Do They Matter?

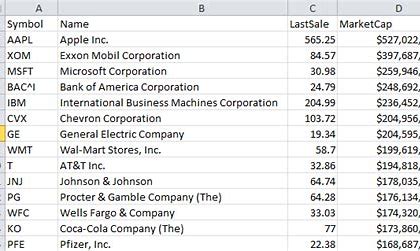

A stock name typically refers to the publicly traded name of a company listed on a stock exchange. Recognizing these names and understanding the businesses they represent is the first step in assessing potential investments. Stock names like Apple (AAPL), Tesla (TSLA), and Amazon (AMZN) are household terms, but lesser-known names can also offer significant opportunities.

By examining stock names, investors can categorize companies into sectors, identify growth or value stocks, and diversify portfolios effectively.

How to Evaluate Stock Names for Investment

1. Understand the Business Model

Behind every stock name is a business. Assess the company’s:

- Core Products or Services: Determine if the company operates in a stable or high-growth industry.

- Competitive Advantage: Look for strong branding, innovation, or market leadership.

- Revenue Streams: Ensure diversified income sources to mitigate risks.

2. Analyze Financial Health

Review financial metrics such as:

- Earnings Per Share (EPS): A higher EPS indicates profitability.

- Price-to-Earnings (P/E) Ratio: Compare a stock’s valuation to industry peers.

- Debt-to-Equity Ratio: Lower ratios signify financial stability.

3. Assess Market Trends

Certain stock names perform better during specific market conditions. For example:

- Tech Stocks: Often thrive during innovation booms (e.g., NVIDIA, Microsoft).

- Defensive Stocks: Like Procter & Gamble, these remain stable during downturns.

- Emerging Markets: Stocks tied to growing economies can offer high returns but come with added risk.

Diversifying Across Stock Names

A well-diversified portfolio includes a mix of:

- Blue-Chip Stocks: Established names like Coca-Cola or IBM.

- Growth Stocks: Companies with rapid revenue expansion, such as Shopify.

- Dividend Stocks: Stocks providing regular payouts, like Johnson & Johnson.

- Small-Cap Stocks: High-growth potential names like emerging startups.

By spreading investments across stock names in different sectors and market caps, you can reduce risks and improve overall portfolio performance.

Tools and Resources for Stock Name Analysis

JD Trader simplifies the process of analyzing stock names with:

- Comprehensive Stock Screeners: Filter stocks based on sector, valuation, and growth metrics.

- Real-Time Market Data: Track stock names and monitor performance trends.

- Expert Insights: Access in-depth analysis of top-performing and emerging stock names.

- Portfolio Management Tools: Optimize your holdings with risk assessment features.

Common Pitfalls to Avoid

- Overconcentration: Avoid focusing too heavily on a single stock name or industry.

- Ignoring Fundamentals: Don’t be swayed by hype or brand recognition alone. Always analyze financials.

- Chasing Trends: Prioritize long-term growth over short-term market fads.

Conclusion

Selecting stock names for your portfolio requires a strategic approach that combines thorough research, diversification, and an understanding of market trends. JD Trader provides the tools and expertise you need to make informed decisions and build a resilient investment portfolio.

Whether you’re a seasoned trader or just starting, let JD Trader help you navigate the vast landscape of stock names and uncover opportunities that align with your goals.