The T stock price, representing AT&T Inc. (NYSE: T), is closely watched by investors seeking stability and dividend income in the telecommunications sector. As one of the largest telecom companies in the U.S., AT&T plays a critical role in the industry, and its stock price is influenced by various factors, including earnings reports, market trends, and industry developments. In this article, we’ll analyze the recent performance of T stock, key factors affecting its valuation, and whether it remains a good investment.

Recent Performance of T Stock Price

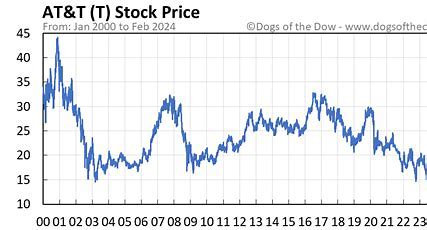

AT&T’s stock has experienced fluctuations in recent years due to restructuring efforts, competition, and economic conditions. Investors tracking T stock price should consider:

- Revenue Growth: AT&T generates revenue from wireless services, broadband, and enterprise solutions. Strong earnings reports often lead to positive stock movements.

- Debt Management: AT&T has made efforts to reduce debt after its Time Warner acquisition and subsequent spin-off of WarnerMedia. Lower debt levels can improve investor confidence.

- Dividend Yield: Known for its attractive dividend yield, AT&T remains a popular choice among income investors. The company’s ability to sustain and grow dividends impacts stock sentiment.

Factors Influencing T Stock Price

📌 Industry Competition – The telecom industry is highly competitive, with AT&T facing rivals like Verizon (VZ) and T-Mobile (TMUS). Market share changes can influence stock performance.

📌 5G Expansion – AT&T’s investment in 5G technology and infrastructure plays a key role in future revenue growth. Investors watch these developments closely.

📌 Macroeconomic Conditions – Interest rates, inflation, and consumer spending habits affect AT&T’s stock price, as the company relies on customer subscriptions.

📌 Regulatory Environment – Government policies on net neutrality, mergers, and spectrum allocation can impact AT&T’s business operations and, in turn, its stock price.

Is T Stock a Good Investment?

✅ Pros:

- Strong Dividend Yield – AT&T is considered a high-yield dividend stock, attracting income-focused investors.

- 5G & Fiber Growth Potential – Expansion in 5G and fiber broadband services positions AT&T for future growth.

- Stable Revenue Streams – Telecommunications services remain essential, providing consistent cash flow.

❌ Cons:

- Debt Levels – Despite reductions, AT&T still carries a significant amount of debt, which could limit financial flexibility.

- Competitive Pressures – T-Mobile’s aggressive pricing and market expansion challenge AT&T’s growth.

Conclusion: Should You Buy T Stock?

The T stock price remains a key indicator of AT&T’s financial health and growth prospects. While it offers stability and dividend income, investors should carefully assess market conditions, competitive pressures, and the company’s long-term strategy before investing. For the latest insights and expert analysis on T stock and other investment opportunities, trust JD Trader to help you navigate the market with confidence.